PETROLEUM EXPLORATION

OPPORTUNITIES IN JORDAN

PT. I

1. Introduction: The Hashemite Kingdom of Jordan (Jordan) is a Middle Eastern Arab country, which is a trading center and crossroad between east and west since early historic times. The country (Figure #1) occupies an ancient land of unique beauty and contrast, situated at the confluence of Asia, Africa and Europe. Jordan is rich in tourist attractions such as the Roman city of Jerash, Dead Sea and the rose city of Petra, a UNESCO World Heritage Site.

The Kingdom is constitutional Monarchy, the King appoint a Council of

Ministers which is accountable to a two house parliaments: the Upper House with 55 members appointed by the King himself and the Lower House with 110 members elected by the people of Jordan. Freedom of religious beliefs, speech, press and private property are guaranteed by the constitution. In recent years, Jordan has developed into a modern country with distinguished sense of place and a simple way of life. Jordanians are very friendly and outgoing people and visitors feel the warm hospitality wherever they travel in the country.

Jordan occupies an area of 89,300 sq. kms between latitudes 29 and 33 north and longitudes 34 and 39 east. With this area, Jordan is slightly larger than Austria and about three times the size of Belgium. Jordan (Figure #2) comprises three geomorphologic subunits: The Wadi Araba Jordan Depression which extends 360 kms from Aqaba to northern part of the country. This depression has the lowest point on earth near the Dead Sea (about 400 m below sea level).The rugged topography distinguishes northern and northwestern parts of Jordan where Ajloun mountains are dominant features. The highest elevation in Jordan is about 1800m in Shera Mountains west of Ma'an in South Jordan. The northeastern desert comprises two units: the Basalt Plateau which is part of the basalt cover of about 45,000 sq. Kms from the sourthern edge of Damascus basin in Syria to east of Wadi Sirhan Depression in Saudi Arabia. The Jordanian part is approximately 11,000 sq.kms. The northeastern Limestone Plateau extends east of Basalt Plateau to the border with Iraq. Central and southeastern parts of Jordan which include Wadi Rum, ElJafr and Wadi Sirhan areas are basically semi deserts with sandstone cuestas and deeply incised valleys along the scarps.

Jordan climate is that of eastern Mediterranean region where it is hot and dry in summer and rainy in winter. The average temperature in Amman is 8 degrees Celsius (46 F) in January, 16 degrees Celsius (60 F) in April and 28 degrees Celsius (82 F) in July. There are many cases where summer temperatures can go up to 40 degrees Celsius and winter temperatures can go down below freezing. Aqaba on Red Sea and Dead Sea areas are warm winter resorts. The rainy season normally extends from late October through March. Petroleum operations are never hindered by weather and can be conducted all year around.

2. Economy - Overview:

Jordan's economy is among the smallest in the Middle East, with insufficient supplies of water, oil, and other natural resources, underlying the government's heavy reliance on foreign assistance. Other economic challenges for the government include chronic high rates of poverty, unemployment, inflation, and a large budget deficit. Since assuming the throne in 1999, King ABDALLAH has implemented significant economic reforms, such as opening the trade regime, privatizing state-owned companies, and eliminating most fuel subsidies, which in the past few years have spurred economic growth by attracting foreign investment and creating some jobs. The global economic slowdown, however, has depressed Jordan's GDP growth. Export-oriented sectors such as manufacturing, mining, and the transport of re-exports have been hit the hardest. The Government approved two supplementary budgets in 2010, but sweeping tax cuts planned for 2010 did not materialize because of Amman's need for additional revenue to cover excess spending. The budget deficit is likely to remain high, at 5-6% of GDP, and Amman likely will continue to depend heavily on foreign assistance to finance the deficit in 2011. Jordan's financial sector has been relatively isolated from the international financial crisis because of its limited exposure to overseas capital markets. Jordan is currently exploring nuclear power generation to forestall energy shortfalls.

GDP (purchasing power parity):

$33.79 billion (2010 est.)

country comparison to the world: 103

$32.74 billion (2009 est.)

$31.98 billion (2008 est.)

note: data are in 2010 US dollars

[see also: GDP (purchasing power parity) country ranks ]

GDP (official exchange rate):

$27.13 billion (2009 est.)

[see also: GDP (official exchange rate) country ranks ]

GDP - real growth rate:

3.2% (2010 est.)

country comparison to the world: 111

2.4% (2009 est.)

5.8% (2008 est.)

[see also: GDP - real growth rate country ranks ]

GDP - per capita:

$5,300 (2010 est.)

country comparison to the world: 142

$5,200 (2009 est.)

$5,200 (2008 est.)

note: data are in 2010 US dollars

[see also: GDP - per capita country ranks ]

GDP - composition by sector:

agriculture: 3.4%

[see also: GDP - composition by sector - agriculture country ranks ]

industry: 30.3%

[see also: GDP - composition by sector - industry country ranks ]

services: 66.2% (2009 est.)

[see also: GDP - composition by sector - services country ranks ]

Labor force:

1.719 million (2009 est.)

country comparison to the world: 126

[see also: Labor force country ranks ]

Labor force - by occupation:

agriculture: 2.7%

[see also: Labor force - by occupation - agriculture country ranks ]

industry: 20%

[see also: Labor force - by occupation - industry country ranks ]

services: 77.4% (2007 est.)

[see also: Labor force - by occupation - services country ranks ]

Unemployment rate:

13.4% (2010 est.)

country comparison to the world: 139

12.9% (2009 est.)

note: official rate; unofficial rate is approximately 30%

[see also: Unemployment rate country ranks ]

Population below poverty line:

14.2% (2002)

[see also: Population below poverty line country ranks ]

Household income or consumption by percentage share:

lowest 10%: 3%

[see also: Household income or consumption by percentage share - lowest 10% country ranks ]

highest 10%: 30.7% (2006)

[see also: Household income or consumption by percentage share - highest 10% country ranks ]

Distribution of family income - Gini index:

39.7 (2007)

country comparison to the world: 63

36.4 (1997)

[see also: Distribution of family income - Gini index country ranks ]

Investment (gross fixed):

30.1% of GDP (2009 est.)

country comparison to the world: 18

[see also: Investment (gross fixed) country ranks ]

Budget:

revenues: $6.269 billion

[see also: Budget - revenues country ranks ]

expenditures: $8.701 billion (2009 est.)

[see also: Budget - expenditures country ranks ]

Public debt:

61.4% of GDP (2010 est.)

country comparison to the world: 29

64.7% of GDP (2009 est.)

[see also: Public debt country ranks ]

Inflation rate (consumer prices):

4.4% (2010 est.)

country comparison to the world: 128

-0.7% (2009 est.)

[see also: Inflation rate (consumer prices) country ranks ]

Central bank discount rate:

4.75% (31 December 2009)

country comparison to the world: 73

6.25% (31 December 2008)

[see also: Central bank discount rate country ranks ]

Commercial bank prime lending rate:

9.25% (31 December 2009 est.)

country comparison to the world: 104

9.03% (31 December 2008 est.)

[see also: Commercial bank prime lending rate country ranks ]

Stock of narrow money:

$9.386 billion (31 December 2010 est)

$8.437 billion (31 December 2009 est)

[see also: Stock of narrow money country ranks ]

Stock of broad money:

$35.53 billion (31 December 2010 est.)

$33.38 billion (31 December 2009 est.)

[see also: Stock of broad money country ranks ]

Stock of domestic credit:

$26.85 billion (31 December 2010 est.)

country comparison to the world: 72

$25.14 billion (31 December 2009 est.)

[see also: Stock of domestic credit country ranks ]

Market value of publicly traded shares:

$31.86 billion (31 December 2009)

country comparison to the world: 54

$35.85 billion (31 December 2008)

$41.22 billion (31 December 2007)

[see also: Market value of publicly traded shares country ranks ]

Agriculture - products:

citrus, tomatoes, cucumbers, olives, strawberries, stone fruits; sheep, poultry, dairy

Industries:

clothing, fertilizers, potash, phosphate mining, pharmaceuticals, petroleum refining, cement, inorganic chemicals, light manufacturing, tourism

Industrial production growth rate:

2.7% (2009 est.)

country comparison to the world: 116

[see also: Industrial production growth rate country ranks ]

Electricity - production:

12.21 billion kWh (2007 est.)

country comparison to the world: 85

[see also: Electricity - production country ranks ]

Electricity - consumption:

10.4 billion kWh (2007 est.)

country comparison to the world: 85

[see also: Electricity - consumption country ranks ]

Electricity - exports:

176 million kWh (2007 est.)

[see also: Electricity - exports country ranks ]

Electricity - imports:

200 million kWh (2007 est.)

[see also: Electricity - imports country ranks ]

Oil - production:

0 bbl/day (2008 est.)

country comparison to the world: 170

[see also: Oil - production country ranks ]

Oil - consumption:

108,000 bbl/day (2009 est.)

country comparison to the world: 74

[see also: Oil - consumption country ranks ]

Oil - exports:

0 bbl/day (2007 est.)

country comparison to the world: 191

[see also: Oil - exports country ranks ]

Oil - imports:

108,200 bbl/day (2007 est.)

country comparison to the world: 63

[see also: Oil - imports country ranks ]

Oil - proved reserves:

1 million bbl (1 January 2010 est.)

country comparison to the world: 97

[see also: Oil - proved reserves country ranks ]

Natural gas - production:

250 million cu m (2008 est.)

country comparison to the world: 72

[see also: Natural gas - production country ranks ]

Natural gas - consumption:

2.97 billion cu m (2008 est.)

country comparison to the world: 73

[see also: Natural gas - consumption country ranks ]

Natural gas - exports:

0 cu m (2008 est.)

country comparison to the world: 83

[see also: Natural gas - exports country ranks ]

Natural gas - imports:

2.72 billion cu m (2008 est.)

country comparison to the world: 42

[see also: Natural gas - imports country ranks ]

Natural gas - proved reserves:

6.031 billion cu m (1 January 2010 est.)

country comparison to the world: 87

[see also: Natural gas - proved reserves country ranks ]

Current account balance:

-$975 million (2010 est.)

country comparison to the world: 135

-$1.27 billion (2009 est.)

[see also: Current account balance country ranks ]

Exports:

$7.333 billion (2010 est.)

country comparison to the world: 98

$6.366 billion (2009 est.)

[see also: Exports country ranks ]

Exports - commodities:

clothing, fertilizers, potash, phosphates, vegetables, pharmaceuticals

Exports - partners:

US 17.13%, Iraq 17%, India 13.59%, Saudi Arabia 10.56%, Syria 4.18%, UAE 4.09% (2009)

Imports:

$12.97 billion (2010 est.)

country comparison to the world: 83

$12.5 billion (2009 est.)

[see also: Imports country ranks ]

Imports - commodities:

crude oil, machinery, transport equipment, iron, cereals

Imports - partners:

Saudi Arabia 17.3%, China 10.95%, US 6.94%, Germany 6.29%, Egypt 6.1% (2009)

Reserves of foreign exchange and gold:

$12.64 billion (31 December 2010 est.)

country comparison to the world: 50

$12.14 billion (31 December 2009 est.)

[see also: Reserves of foreign exchange and gold country ranks ]

Debt - external:

$5.522 billion (31 December 2010 est.)

country comparison to the world: 101

$6.766 billion (31 December 2009 est.)

[see also: Debt - external country ranks ]

Stock of direct foreign investment - at home:

$22.19 billion (31 December 2010 est.)

country comparison to the world: 66

$19.76 billion (31 December 2009 est.)

[see also: Stock of direct foreign investment - at home country ranks ]

Stock of direct foreign investment - abroad:

$NA

[see also: Stock of direct foreign investment - abroad country ranks ]

Exchange rates:

Jordanian dinars (JOD) per US dollar - 0.709 (2010), 0.709 (2009), 0.709 (2008), 0.709 (2007), 0.709 (2006)

NOTE: The information regarding Jordan on this page is re-published from the 2011 World Fact Book of the United States Central Intelligence Agency. No claims are made regarding the accuracy of Jordan Economy 2011 information contained here. All suggestions for corrections of any errors about Jordan Economy 2011 should be addressed to the CIA.

3. Summary Jordan Geology:

Jordan occupies the northwest part of the Arabian plate where most of the country is located within the stable shelf part of the plate. The late Proterozoic was characterized by Arabian Shield cratonization and island arcs accretions with basement sutures indicating east west compressional forces. Extensional, riftrelated tectonics dominated the area during late Precambrian early Cambrian periods. The (NW/SE) Najd Fault System which originated in this period has resulted in the formation of large depressions that were subsequently filled with Paleozoic clastics. Passive margin conditions with periods of transgressions and regression dominated Jordan during early Paleozoic whereas active tectonic movements of deep erosion have dominated late Paleozoic periods. Upper Ordovician glacial clastics and lower Silurian organic rich shales were among the most important sediments deposited in this period. Most of Paleozoic basins in Jordan are compartmentalized by Cretaceous Tertiary wrench faults related to late Cretaceous fragmentation of Arabian plate.

During Permo Triassic, an extensional tectonics has rifted Arabia from Turkish Iranian Gondwanan fragments. Although extensional tectonics characterized Jordan during late Cretaceous, the western margin of Levant was characterized by EW to WNW ESE Compressional feature known as Syrian Arc.

Mesozoic Cenozoic basins in Jordan are dominantly rift related (Azraq, Safawi and Northern Highlands). A mid Tertiary tectonic phase has resulted in opening of Gulf of Aden Red Sea and leading to development of Dead Sea Wadi Araba plate boundary that separated Arabian plate from African plate, and sutured the Arabian plate to Eurasia. Pull a part basins of thick sedimentary piles resulted from this phase.

Regional north south cross section from Syria into Jordan is shown in Figures #3, whereas regional (east west) cross section is illustrated in Figure #4 and 5.

4. Petroleum Exploration and PSA Overview:

Oil exploration in Jordan started as early as 1947, when the Iraqi Petroleum Company (IPC) was the first company to start exploring for oil in 1947. After some geological mapping, gravity and magnetic surveys the company relinquished its license in 1954.

Edwin Pauly / Phillips acquired license between 1955 and 1961 where geological and geophysical works have been conducted, in addition to drilling of six well (Safra1,

Halhoul1, Ramalla1, Suwileh1, JordanVally1, Lisan1).

The period 19641978 has witnessed some activities by John Mecom, INA,Total, Filon, Fuyo and NRAwhere 14 wells have been drilled, in addition to limited seismic, gravity and magnetic surveys.

In 19811996, the Jordanian government decided to increase oil exploration efforts from treasury funds where 83 wells have been drilled in addition to acquiring of about 34,030 Kms of 2D seismic (more seismic data including 3D were added in 2010 by Sonoran Energy. Universal and Global Petroleum). These efforts resulted in discovery of oil in Hamzeh Field, Azraq area (1984) and commerical gas in Risha area (1987), close to the Iraqi borders. In parallel, foreign oil companies have worked in different blocks of Jordan under Production Sharing Agreement (PSA) terms and Technical Assistance Programs.

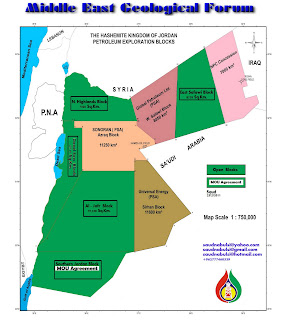

At present Jordan is subdivided into (09) exploration blocks as shown in Figure (6):-

-The Risha Block in northeast Jordan is under 50 years concession agreement with JordanNational Petroleum Company (NPC) since 1996. It contains the Gas field in Jordan.

-The Dead Sea Block: was under Production Sharing Agreement (PSA) with American Trans Global Petroleum Limited. This block now is open.

-Azraq Block is currently under Production Sharing Agreement (PSA) with Sonoran Energy Inc. Hamza oil field was discovered in this block in 1987.

-East Safawi Block was under Production Sharing Agreement (PSA) with Petrel

Resources Plc. of Republic of Ireland. Now it is open for interest companies.

-West Safawi Block is under Production Sharing Agreement (PSA) with Global

Petroleum Limited of Republic of India.

-North Highlands Block is open for interested companies

-Jafr & Central Jordan Block is an open block for interested oil companies.

-Sirhan Block is under Production Sharing Agreement (PSA) with Universal Petroleum Limited of Republic of India.

- The Southern Jordan Block is under MOU agreement with the Russian

The NRA data base include geological, geophysical, drilling, completion development and production data on about 120 wells and 34,030 line km of 2DSeismic data.(Additional 2D seismic was acquired recently in 2010). Old coverage of 3D seismic is restricted to Lisan Peninsula of the Dead Sea and parts of Risha area in northeast Jordan. (Additional 2D seismic was acquired recently in 2010).

In addition to Gas production from Risha Gas Field and Oil from Hamza Oil Field, many oil shows and hydrocarbon occurrence were reported in Jordan (Figure #7). Blake in 1889 described oil seeps at Ain AlHummar, situated on the east side of the Dead Sea, 5kms south of the mouth of wadi Mujib. The seepage is from the base of the Cambrian Umm Ishrin Sandstone, some of these occurrences have been famous since early recorded history. Geochemical data indicate that the source rock for this oil is most likely the Cretaceous oil shales buried deeply in the graben area. Recently a measurable flow of oil (25 BBL/D) was obtained from a shallow hole drilled by NRA at this location. Other seepages were encountered along the Eastern and Western sides of the Dead Sea & Jordan River.

Asphalt occurs in and near the Dead Sea as blocks or as concretions, veins, cavity and fissure fillings or as Ozocerite veins. Histrorically large blocks of asphalt were occasionally found floating on the surface of the Dead Sea waters, of variable size, some of the blocks have been reported to be as large as 150 cubic meters in volume.

The Greek historian Diodoros (10244B.C) reported "the Dead Sea is a large sea which yields much asphalt and from which by no means negligible revenue is drawn". Description of the Dead Sea asphalt by other ancient historians are remarkably consistent with Diodoros report. The asphalt is very pure and has a high luster on a fresh face and specific gravity of 1.118. Analysis of gases issuing with sulphur depositing spring water at ELMirriwha east of the Lisan on the Dead Sea shorelines indicates heavy hydrocarbon fractions in these gases.

The known outcrops of tar sand in Jordan are located in Wadi Issal, Wadi Aheimir and Ed Dhira along the high escarpment east of Lisan Peninsula overlooking the Dead Sea. Wadi Issal lies 170 km south of Amman and 30km to the west of Kerak City. The twenty drilled wells revealed that the deposit reserve is 40 million metric ton. The recoverable tar is estimated 3.6% of total rock volume. Sixteen wells in East Issal and one well in Ahuimer Issal areas, but due to bad quality of the deposits stalled to be considered as reserves. Stratigraphically, the sandstone bodies that are saturated with heavy hydrocarbons are limited to the Lower Cretaceous Kurnub Sandstone and the underlying Upper Cambrian Umm Ishrin Sandstone. The lateral and vertical distribution of these impregnated rocks is very irregular. Tar Sand was originated from the organic maturation of bituminous marly limestones of Ghareb Formation that was deeply buried in the Dead Sea Basin.

Add to the above a huge Oil Shale deposits occur mostly within the lower part of the Muwaqqar Chalk Marl Formation (Maastrichtian Paleocene). The Formation consists of limestone, phosphatic marls, shales and phosphates. This formation is widely distributed and encountered in all sedimentary basins of Jordan.

The geological history and the stratigraphic column provide multiple TPS, which greatly enhance the petroleum potentiality of the country. A qualitative assessment of the petroleum potential of Jordan is focused upon the following salient facts:

-The petroleum resources of the country have not been adequately tested.

-There are numerous oil and gas shows throughout Jordan even in wells that were not located on valid structures.

-There is an abundant of surface indications of hydrocarbons, in the form of seeps, asphalt impregnations, and near surface deposit of rich oil shales.

-The NRA exploration program has provided a good data base from which to conduct exploration in basins with proven oil potential.

-A favorable model contract have been adopted which offer attractive economic terms to the international petroleum Industry.

-New insights into the subsurface geology of Jordan, gained by new seismic work and reprocessing of old seismic data, reveal the existence of deep basins with attractive structural styles which are essentially untested.

Azraq Block: Sonoran Energy Jordan Ltd.

Traps: Horst blocks, Tilted faulted blocks, up thrown fault blocks, en - echelon anticlines, west margin up dip anticlines

Reservoirs: Triassic sands and carbonates? Albian/Aptian sandstones, Cenomanian \ Turonian carbonates, Campanian sands.

Sources: Cenomanian Shale and Turonian carbonates

Triassic shales, Silurian shales (Partial Distribution) ?

Seals: Shales, evaporites

Hydrocarbons: Oil production in Cenomanian carbonates.

(Hamza Oil Field which was discovered in 1984). Vast occurrence of heavy oil and huge oil shale deposits in the Upper Cretaceous carbonates,

Northern Highlands Block: Open

Traps: North plunging regional high with domal structure, horst blocks,

anticlines, marginal swells, up dip Damascus basin faulted block, elongated faulted blocks associated with Jordan valley strike Slip fault

Reservoirs: Permo\Triassic, Triassic, Jurassic

Sources: Triassic, Jurassic shales and carbonates

Seals: Evaporaties and shales

Hydrocarbons: Oil seeps, live oil show in Jurassic carbonates of

Well NH2, shut in gas field on the western side of the border, Hamza oil field just to the east of this block.

West Safawi: Global Petroleum Ltd.

East Safawi (Basalt Plateau) Open

Traps: Horst and tilted fault blocks, Graben associated structures

Stratigraphic pinchouts

Reservoirs: Ordovician Cambrian, Triassic sands and carbonates

Sources: Silurian and Ordovician shales, Triassic shales and carbonates

Seals: Shales and evaporites

Risha Gas Field just to the east, New gas discovery in Syria and Saudi Arabia

Dead Sea Block Open

Plays: Fault traps, horst blocks, en echelon folds, Salt related structures.

Reservoirs: Tertiary, Mesozoic and Paleozoic sands

Sources: Maastrichtian oil shales, the Cenomanian and Turonian shales, in the Northern part Triassic and Permo\Triassic

Seals: Salt, shale, argillaceous limestone

Hydrocarbons: Oil in Ain Alhammar well (25 BBL/Day), all wells drilled in the block reported very strong oil and gas shows, abundant oil and gas seeps and shows, Small oil and gas field on western border.

Sirhan Block: Universal Petroleum Ltd

Traps: Rollover, horsts, Paleozoic gentle folds, stratigraphic, pinchouts and porosity variation

Reservoirs: Cambrian and Ordovician sands

Sources: Silurian hot shale

Seals: Shales

Hydrocarbons: Light oil (42 API) in WS4 well, (Ordovician sands)

25 bbls/d Oil shows in several other wells.

Risha Block: NPC

Traps: Gentle rollovers, lowrelief

anticlines. stratigraphic traps.

Reservoirs: Ordovician sands, Triassic sands and carbonates.

Sources: Silurian hot shales, Triassic shales?

Seals: Silurian shales, Triassic evaporites

Hydrocarbons: Gas discovery (Risha Gas Field, 1987) in Ordovician

sands (Production 30 MMCF/day).

Basic PSA Conditions and Fiscal Terms:

The Natural Resources Authority is currently using an Exploration and Production Sharing model (PSA) which is based on the Egyptian model and modified in 1988 by NRA and the consulting firm of Arther D. Little. Several other modifications were introduced recently to accommodate the new government policies of encouraging international companies to invest in the oil and gas sector of the country with the lowest possible capital risk. The following is a brief account on the basic PSA conditions:

* All terms, articles and annexes are negotiable, have the same force and effect and when completed the PSA takes the power of law and published in the official Gazette.

* The exploration period lasts about (6) years is divided into two Terms whereas the development period is (25) years. The commitments for each exploration term usually include the drilling of 1 or 2 wells and / or seismic surveys. The contract terminates if no commercial discovery is made by the end of the first or second exploration term. However, contractor could voluntarily relinquish the license at any time if relevant requirements are satisfied.

* Contractor has the exclusive right to conduct petroleum operations in the described area to any delivery points in Jordan. The rights include construction of roads, pipelines, telecommunication systems, landing fields and other facilities.

* NRA shall support and provide every assistant to contractor in obtaining all necessary approvals, licenses, and permissions from relevant Jordanian authorities.

* Contractor shall bear all expenses of petroleum operations and shall look only for cost recovery share, which he is entitled to under the relevant terms of contract.

* The budget for each exploration term is approximately USD (10) millions but compliance with work commitments shall relieve contractor of the requirement to expend the minimum expenditure obligation. All items entered into the country are exempted from duties if required for petroleum operations. The exemptions of all temporary entries shall be guaranteed from a licensed bank in Jordan 200.000 US$.

* Contractor enjoys free currency exchange, free use of land with the right to export all petroleum, which he is entitled to.

* The model contract contains many other articles on relinquishments, conduct of operations, training and production bonuses, Assignment, gas, supply of internal demand and general provisions.

* The annexes to the contract include provisions on area, accounting procedures, tax implementation provisions, form of bank guarantee, performance bond and Parent Company Guarantee.

A full copy of the model contract and more technical information regarding the open blocks, can be provided to the interested oil companies upon request from:

Middle East Geological Forum Company

info@megf-jo.com

saudnabulsi@gmail.com

00962777460539